How To Use Intelligent Targeting In Banking Industry

In the banking industry, conversion marketing combined with intelligent targeting allows you to pick the right tool for converting each potential visitor.

Conversion marketing means using tools like live chat, CoBrowsing, banners, and pop-ups to drive traffic (prospects) through your online sales pipeline.

In the banking industry, a pipeline may mean credit card applications, savings account openings, or booking face-to-face meetings at a local office to mention a few examples. Conversion marketing combined with intelligent targeting allows you to pick the right tool for converting each potential visitor according to your business goals.

In this blog, I have collected some examples for the banking sector to help you get started.

Collect leads for your telesales and local branches

A great deal of money is spent on acquiring web traffic on bank's website. Using a live chat this traffic can be converted to leads for telesales or straight to meetings at a local branch. By implementing a targeted live chat, a sales team can have conversations with selected audience and collect contact information or book face-to-face meetings. The key to success here is to limit the live chat invites to only right prospects. For example, trigger the chat invite when a visitor fills in a loan calculator or lands on your site from a particular Google ad. Of course, do use a callback form when live chat agents are not available.

Boost conversion of online applications

Use of pop-ups and banners for guiding interested visitors through a sales pipeline is underutilised in the banking sector. For example, one could use a pop-up to offer a perk for a visitor who completed a loan calculator but, for some reason, did not proceed to loan application. Alternatively, one might target those who started to fill an application but backtracked to the home page. How about targeting a visitor, who has visited multiple pages about a mortgage, with an encouragement to use your handy loan calculator?

Make sure each form gets completed

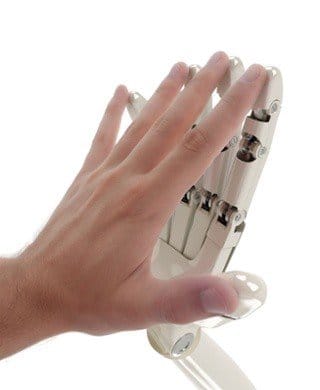

A standard bank website has various forms for customers to use for reaching out. These vary from (hopefully) simple 'contact us' forms to gigantic loan applications. Honestly, show hands everyone with 15 or more questions on the very first page of your loan application. A big chunk of potential customers starting to fill these forms never finish. Either they are not patient enough, or they simply don't know how to answer some of the questions. To improve the rate of filled applications, target hesitant behaviour with help offering. For 'contact us forms', pop out a live chat and for more complicated forms offer support via CoBrowsing. By the way, did you know that CoBrowse works with smartphones as well?

Go where your potential customers are

The Internet is a huge place. I am willing to bet that you have more potential customers on other sites at any given time than on your own. The traditional idea is to use marketing to pull prospects to your landing pages. What if we flip the setting around and your online sales agents go where the audience is already? Interesting places for banks to be and chat are, for example, online stores, travel agencies, and, depending on the market, real estate portals and agencies' websites. Those are the places where consumers in need of loan are!

This blog was originally published on giosg.com Ltd's blog (Oct 18, 2016). Text has since been edited for clarity. Read the original here.